When the emotions of fear or greed take over, things go awry in both private and public sector negotiation. War making is state action historically done for security; trade making is state action undertaken when mutual opportunity is sought. Ultimately, very powerful Super Sovereigns such as the European Union or the victors of World War I can collapse under their own weight as they directly impact a nation’s ability to negotiate a future of its own design.

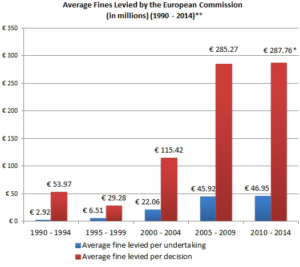

A few years ago I followed antitrust enforcement activity through excellent data sets from Gibson Dunn (see Average Fines graph, below). As clients expanded into Europe, we watched their behavior being punished, not their market power per se, but under anti-competitive actions. So while the likes of Apple and Microsoft have market power, the EU has enforced against many other entities that do not get headlines and second guessed member states’ negotiations. This has to do with the Super Sovereign’s need to correct undesirable behavior with an ultra regulatory regime that is imposed on top of sovereign, province, prefecture, and local regulations. Some regulations are removed, some are retained, some others are pre-empted, additive, or superseded. At some point in complex systems signals are lost, interaction is intermittent, and linkages are interrupted. In a complex regulatory regime, enforcement becomes unequal.

The Super Sovereign regulatory regime is not a pact, agreement, or standard. The Super Sovereign’s enforcement mechanism is very real. Fines are paid and individuals are imprisoned for various economic crimes. Without a voice in regulatory rule making or the history of a presumption of innocence, mistakes are made, enforcement can be asymmetric, and the innocent do get punished on occasion while the guilty go free. True enough for any complex system, but we have past data to draw on to understand how the Super Sovereign cannot punish what a sovereign is unwilling to do.

In the years leading up to World War II, Super Sovereigns seized German property because it was unable to make debt payments that the Treaty of Versailles imposed. This seizure included capital assets and real property. The recent Apple fine is a touchstone due to its size and one wonders, can hundreds of professionals, sovereign agreements, and negotiations be wrong by billions of dollars? Something seems odd here.

The issue with the most recent ruling is complexity of negotiation, involving the sovereign nation itself. In the case of Apple, while Ireland gave Apple a tax break that it does not offer others, it signaled to both Apple and the EU that Ireland was prepared to waive the tax. The Super Sovereign did not like Ireland’s independence, and they ruled taxes or tax breaks cannot be waived.

America has a different culture. Imagine if the federal government told Washington County, Oregon they could not give Intel a break. Intel is a company that employs thousands and invests billions in the Oregon economy. So the biggest issue with the Super Sovereign is that it denies nations their right to negotiate. Europe has a history of choosing war over diplomacy when there is an impasse. Impasses can be broken. And the more aggressive the action by the Super Sovereign, the less power it will wield in the long run. This action is the tipping point. Do we want a world that is negotiated or one that is determined by another without our input?